[ad_1]

GlobalData’s survey reveals that more than a quarter of SMEs are purchasing cyber insurance in response to media coverage of cyberattacks. In the past year alone, over 300 organisations have fallen victim to the ransomware group Qilin targeting sensitive information.

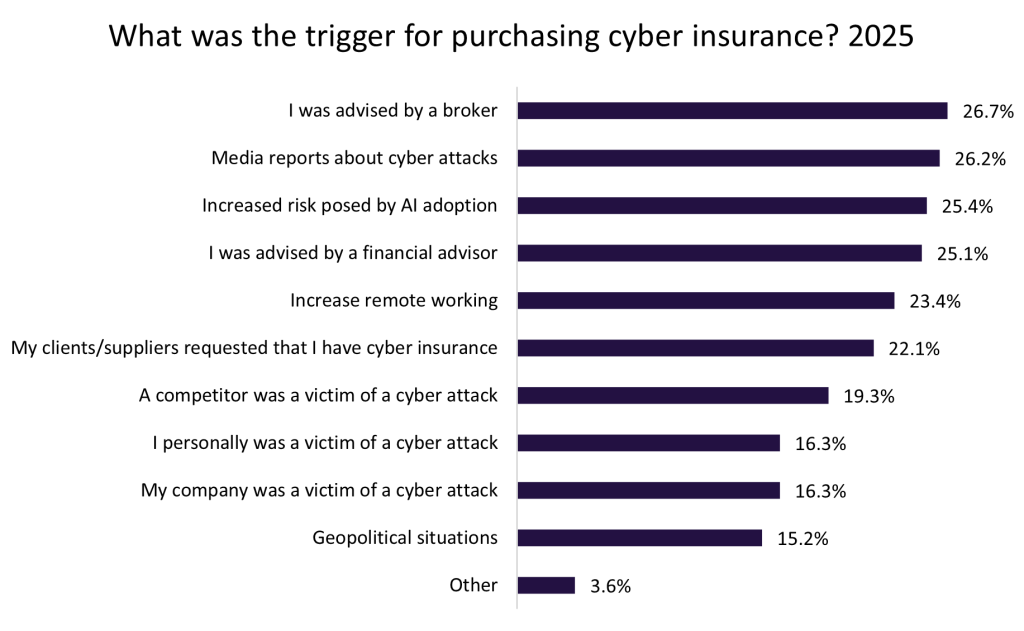

According to GlobalData’s UK SME Insurance Survey 2025, 26.2% of SMEs cited media reports about cyberattacks as their reason for acquiring cyber insurance, while 19.3% indicated that a competitor’s victimisation influenced their decision. This trend highlights increasing concerns and awareness regarding the risks posed by cyberattacks within the industry, particularly in areas such as data security, where advancements in AI could be leveraged to create more sophisticated threats.

Asefa, the Madrid-based subsidiary of French insurer SMABTP, is the latest organisation to be targeted by the ransomware group Qilin, which claims to have extracted over 200GB of sensitive data from the company. The escalating threat and the rise of similar groups necessitate proactive measures from organisations to enhance their cybersecurity protocols.

Among the 200GB+ of data compromised by Qilin was information related to the prominent Spanish football club FC Barcelona. The leak of documents concerning the club could lead to significant reputational damage for Asefa, given the high-profile nature of the client. This situation underscores the urgent need for companies to evaluate their risk exposure and reassess their cyber insurance coverage.

The Asefa cyberattack underscores the necessity for enhanced cyber resilience in light of the rise of ransomware groups such as Qilin and the use of AI in cyberattacks. As prominent breaches increase awareness among SMEs, insurers have a chance to offer customised cyber solutions and proactive assistance to tackle these challenges.

[ad_2]

Source link