[ad_1]

- DigiCert recently announced its involvement in the National Institute of Standards and Technology (NIST) National Cybersecurity Center of Excellence project, joining IBM and other major tech firms to enhance secure software development using real-world, collaborative approaches.

- This U.S. government-sponsored initiative marks the first integration of key industry technologies to independently evaluate and improve software supply chain security without favoring any single vendor.

- We’ll explore how IBM’s participation in this government-backed cybersecurity collaboration could influence its investment narrative and future sector positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

International Business Machines Investment Narrative Recap

To be a shareholder in IBM right now, you need to believe in the company’s capacity to leverage its hybrid cloud and AI businesses for stable, recurring growth, while maintaining client trust through innovation and partnerships. Although IBM’s participation in the NIST-led cybersecurity initiative showcases its commitment to secure software development, this is not expected to materially shift the company’s most important short-term catalyst, renewed momentum in software and hybrid cloud revenues, or alter the biggest immediate risk, which remains client delays in discretionary software spending.

Among recent developments, IBM’s announcement of its next-generation z17 mainframe, with a focus on AI acceleration and efficiency, stands out. While unrelated to the government cybersecurity project, it directly targets the catalyst underpinning IBM’s growth: driving customer adoption of new infrastructure and defending margins through differentiated, next-gen technology, which remains a primary focus as competitive and macro pressures persist.

By contrast, investors should be particularly mindful of the risk that, despite IBM’s recent partnerships and technology launches, including public sector collaborations, client spending could soften if economic uncertainty prompts more organizations to defer software or consulting investments…

Read the full narrative on International Business Machines (it’s free!)

International Business Machines’ narrative projects $74.4 billion revenue and $10.6 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $4.7 billion earnings increase from $5.9 billion today.

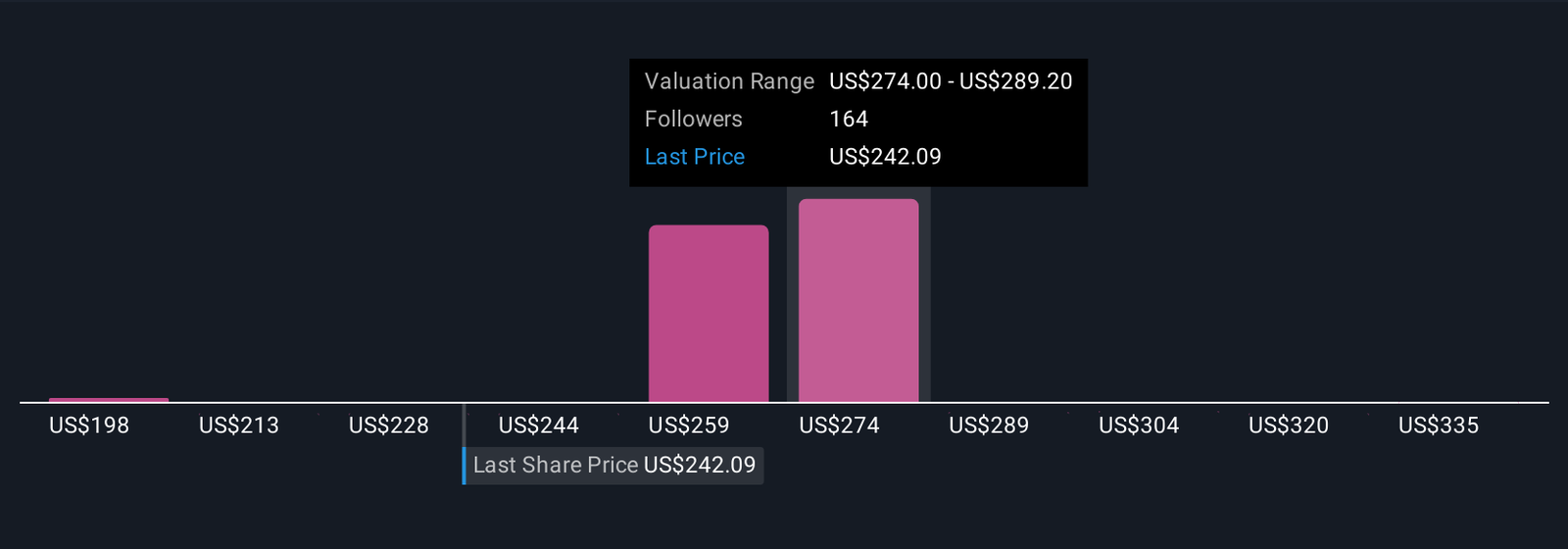

Uncover how International Business Machines’ forecasts yield a $281.77 fair value, a 16% upside to its current price.

Exploring Other Perspectives

While baseline estimates assume steady 5 percent annual revenue growth, the most optimistic analyst forecasts saw US$76.4 billion in revenue and US$12.3 billion in earnings by 2028. These bullish views expect IBM’s hybrid cloud and AI projects to unlock much stronger long-term profitability than typical estimates. Depending on how you interpret IBM’s latest cybersecurity collaboration, this could either reinforce such optimism or present new challenges, so it’s worth considering how much opinions vary among analysts.

Explore 14 other fair value estimates on International Business Machines – why the stock might be worth as much as 45% more than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

[ad_2]