[ad_1]

Mumbai Hit By ₹253 Crore Stock Trading Scam Wave In 2025; Cybercrime Surges With 50% Losses From Fake Investment Apps | FPJ

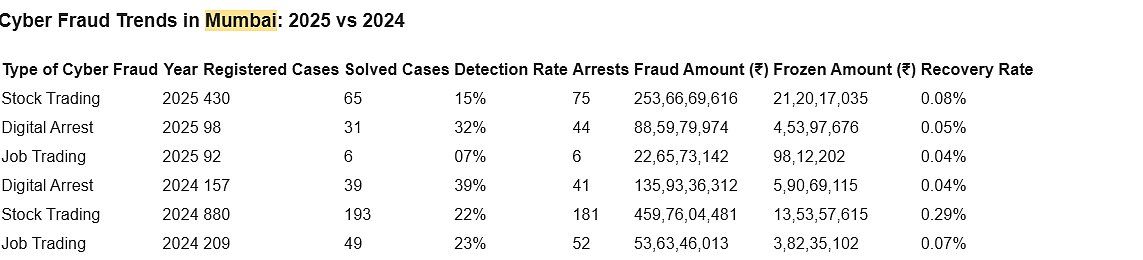

The country’s financial capital is reeling under a staggering wave of cybercrime, with stock market-related frauds emerging as the most devastating threat to investors in 2025. In just the first six months of the year, over Rs253 crore has been siphoned off by fraudsters operating under the guise of online trading—an alarming 50% share of Mumbai’s total reported cyber fraud losses this year.

Among the latest victims is a transport businessman from Andheri West, who was duped of Rs2.53 crore after being lured into a bogus stock trading scheme promising “guaranteed” 200% returns. Police investigations reveal that the perpetrators, posing as financial advisors, added him to a WhatsApp group named “Fyers Online Trading” and directed him to download a counterfeit version of a legitimate trading app. Once onboarded, the businessman was manipulated into making hefty transfers. When he attempted to withdraw his earnings, he was told he must first deposit an additional ₹2 crore—triggering alarm and leading him to report the scam.

This case is far from isolated. In Lower Parel, another investor lost ₹1.44 crore in a nearly identical con, while in Bandra East, a senior MMRDA official was defrauded of ₹1.70 crore. Perhaps most distressing is the case of a 73-year-old woman in Colaba who lost her life savings—₹3.81 crore—entrapped by the same deceptive tactics.

According to Mumbai Cyber Cell’s latest data, these online stock market scams are now the most prevalent form of cybercrime in the city. Of the ₹500 crore in total losses reported till June 2025, more than half stemmed from fake stock trading platforms. Yet, detection and recovery remain dismally low: only 15% of stock fraud cases this year have been solved, and recovery rates hover below 0.1%.

“We are witnessing a paradigm shift in cyber fraud. Stock market scams have become the weapon of choice,” said DCP Purushottam Karad of the Mumbai Cyber Cell. “The public must exercise extreme caution—never download apps from unknown links or share financial data over calls.”

Experts stress vigilance. “Fraudsters now mimic reputed financial platforms with near-identical apps and websites,” warned Ajit Singh, founder of Graded Financial Services. “Social media is crawling with so-called market gurus. Don’t fall for them.”

Cyber law expert Prashant Mali adds, “If it promises extraordinary returns, it’s likely a scam. Trust your skepticism—verify before you invest.”

[ad_2]

Source link

Click Here For The Original Source.