[ad_1]

Palo Alto Networks PANW and Check Point SoftwareCHKP are both at the forefront of the cybersecurity space, playing key roles in guarding organizations from extensive cyberattacks. Both players are taking active roles in enabling enterprises against cloud and endpoint security.

Palo Alto Networks and Check Point Software are riding the key industry trends, driven by the mounting incidents of credential theft, remote desktop protocol breaches and social engineering-based strikes by the malicious actors. Per a Mordor Intelligence report, the cybersecurity space is expected to witness a CAGR of 12.63% from 2025 to 2030.

With this strong growth forecast for the cybersecurity market, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

The Case for Palo Alto Networks

Palo Alto Networks remains a cybersecurity leader, offering solutions for network security, cloud security and endpoint solutions for customers who need full enterprise security support. Its next-generation firewalls and advanced threat detection technologies are widely recognized and adopted globally.

Palo Alto Networks’ wide range of innovative products, strong customer base and growing opportunities in areas like Zero Trust, Secure Access Service Edge (SASE) and private 5G security continue to support its long-term growth potential. Palo Alto Networks’ ongoing technology advancements make it a compelling long-term investment.

For example, in the third quarter of fiscal 2025, SASE was Palo Alto Networks’ fastest-growing segment, with SASE Annual recurring revenues increasing 36% year over year. Moreover, PANW has upgraded its Prisma Cloud platform by adding Prisma Cloud Copilot, a generative AI-powered assistant. This enables security teams to understand and respond to user queries in plain natural language more effectively. Additionally, Prisma Cloud’s recent FedRAMP authorization is expected to help contract wins from federal agencies.

However, Palo Alto Networks is encountering some near-term challenges. The company is experiencing shortened contract durations and a slowdown in the transition to PANW’s cloud-based AI-powered platforms from its legacy platforms. Moreover, Palo Alto Networks’ $1 million-plus deals are shifting from multi-year payments to annual payments, causing the shortening of the sales cycle and affecting top-line stability.

This can cause a deceleration in Palo Alto Networks’ top-line growth. Notably, the company’s revenue growth rate has been in the mid-teen percentage range over the past year, a sharp contrast from the mid-20s percentage in fiscal 2023. In the financial results for the third quarter of fiscal 2025, its sales and non-GAAP EPS grew 15.7% and 21.2%, respectively, year over year.

The Case of Check Point Software

Check Point Software provides several software and combined hardware solutions focused on safeguarding information technology infrastructure. The company’s solutions can either be combined with the operating system, a computer device, a server or a virtual desktop to employ network and gateway security and end-to-end data security.

Check Point Software is experiencing growth in its revenues from the continuous adoption of its cloud solutions and a robust demand for Quantum Force firewalls, up 12% year over year, in the second quarter of 2025, as well as strong momentum in Harmony Email, SASE, and Infinity platforms, each growing above 40% year over year. Rising demand for network security gateways to ensure greater capacities is aiding strong adoption of Check Point Software’s remote access VPN solutions.

Check Point Software is investing heavily in AI-first security, integrating automation and real-time threat prevention across its portfolio. Recent M&A, including Veriti, bolsters Check Point’s proactive threat exposure management. Additionally, Check Point Software has doubled its SASE R&D team and aims to further differentiate through a hybrid architecture that delivers a better user experience and lower cloud costs.

Check Point Software is also increasing its revenues by implementing subscription-based solutions and services. The subscription-based model ensures stable recurring revenues with a high gross margin. However, in the second quarter, subscription growth faced a temporary headwind due to higher discounting from bundled product-refresh deals. Management expects long-term benefits from expanded customer relationships and future upsell opportunities to drive higher subscription growth in the coming quarters.

In the financial results for the second quarter of 2025, Check Point Software’s sales and non-GAAP EPS grew 6% and 9%, respectively, year over year. The Zacks Consensus Estimate for 2025 revenues and EPS indicates a year-over-year increase of 5.9% and 8.2%, respectively.

PANW vs. CHKP: Which Has a Better Growth Profile

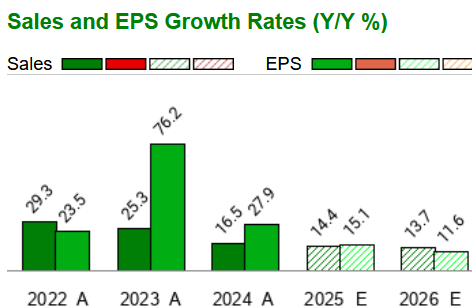

Though both companies are encountering certain challenges, Palo Alto Networks has a better growth profile than Check Point Software. The Zacks Consensus Estimate for PANW’s fiscal 2026 revenues and EPS indicates a year-over-year increase of 13.7% and 11.6%, respectively. The consensus mark for Palo Alto Networks’ fiscal 2026 EPS has been revised a penny upward to $3.65 over the past seven days.

PANW Growth Estimates

Image Source: Zacks Investment Research

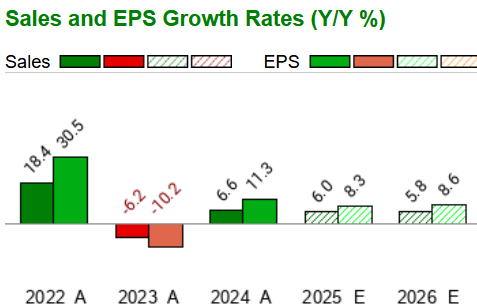

The Zacks Consensus Estimate for Check Point Software’s 2025 revenues and EPS indicates a year-over-year increase of 6% and 8.3%, respectively. The consensus mark for CHKP’s 2025 EPS has remained unchanged at $9.91 over the past 60 days.

CHKP Growth Estimates

Image Source: Zacks Investment Research

PANW vs. CHKP: Price Performance & Valuation

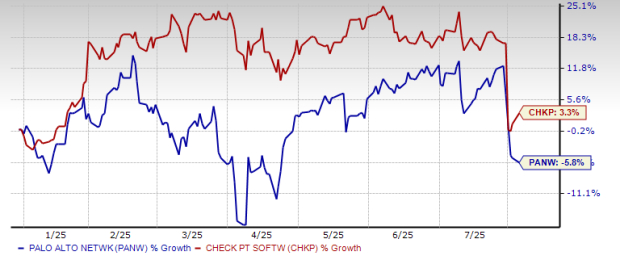

Year to date, Check Point shares have gained 3.3% against the 5.8% decline in Palo Alto Networks shares.

YTD Price Performance

Image Source: Zacks Investment Research

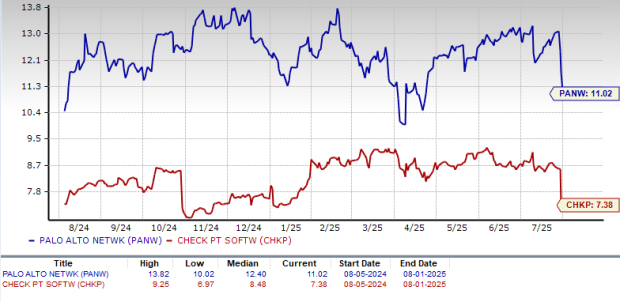

Palo Alto Networks is trading at a forward sales multiple of 11.02X, higher than Check Point Software’s 7.38X. PANW’s higher premium seems justified given its earnings are projected to grow at a higher rate than CHKP. PANW’s valuations also reflect its high growth expectations and robust profitability.

Forward 12 Month P/S Valuation

Image Source: Zacks Investment Research

Conclusion: PANW Has an Edge Over CHKP

Palo Alto Networks’ leadership in the cybersecurity space provides strong revenue visibility for years to come. While the stock trades at a higher valuation than Check Point Software, its explosive growth prospects and strong financial execution more than justify the price. While Check Point Software’s execution risks and a slower growth trajectory suggest that investors should consider holding existing positions or waiting for more attractive entry points.

Currently, Palo Alto Networks carries a Zacks Rank #3 (Hold), making the stock a stronger pick compared with Check Point Software, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Check Point Software Technologies Ltd. (CHKP): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

[ad_2]