[ad_1]

SINGAPORE – Coverage for physical break-ins and theft has long been a fixture in home insurance. Amid the rising tide of cybercrime, a new type of plan has emerged to also protect individuals from digital break-ins.

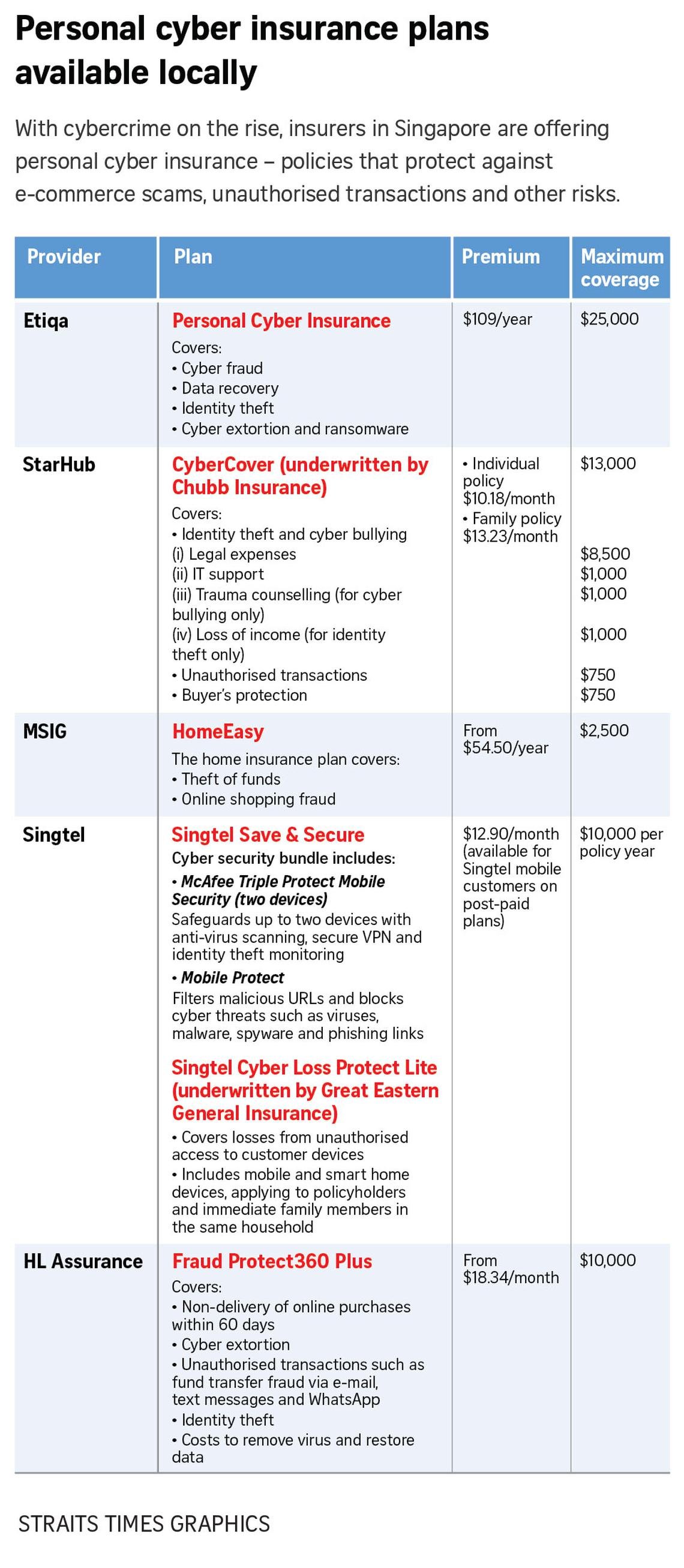

Personal cyber insurance, first rolled out by Etiqa as a standalone policy in 2018, is now offered by at least five insurers in Singapore, reimbursing cybercrime victims up to $25,000 annually for their financial losses.

These plans generally cover cybercrime-related risks such as unauthorised transactions, e-commerce scams and identity theft.

Scam victims in Singapore lost $1.1 billion in 2024, marking a record high in a single year,

according to Singapore police data

.

Police received the highest number of scam reports ever in 2024, with 51,501 cases recorded compared with 46,563 cases the previous year.

The most common ruse in 2024 was e-commerce scams, with 11,665 reported cases and victims losing at least $17.5 million.

The increasing frequency of cybercrime is coupled with gaps in public awareness.

A survey by the Cyber Security Agency of Singapore, released on July 2, found that

three in four people in Singapore cannot distinguish deepfakes from genuine content

– a concern given that deepfakes are predominantly used by criminals to deceive victims.

While two-thirds of respondents in the survey were able to identify all phishing content, only 13 per cent correctly identified all phishing and legitimate content when presented with a mix of both content types.

Notably, $26,000 was lost in two weeks to

Blackpink concert ticket e-commerce scams

in June.

A spokeswoman from General Insurance Association said: “Insurers offering personal cyber insurance policies are responding to emerging consumer protection needs and cyber risks.

“Personal cyber insurance can help mitigate financial losses arising from cyber risks that are covered under such policies.”

Etiqa Singapore launched its personal cyber insurance in 2018 to tackle such growing digital threats. Its current plan still offers up to $25,000 in annual coverage to insure individuals against cyber fraud, cyber extortion and identity theft and covers restoration of data.

“As Singaporeans’ lives become more digitally interconnected, this insurance provides essential protection against the inherent risks of online activities, providing customers with financial protection and peace of mind,” said a spokeswoman for Etiqa.

Etiqa has been joined by more players in recent times.

In February 2022, local telco StarHub partnered underwriter Chubb Insurance to launch CyberCover, a personal cyber insurance scheme that is part of the SafeHub+ suite of cyber-security tools.

CyberCover includes coverage for identity theft, cyber bullying, unauthorised transactions and buyer’s protection. SafeHub+ also includes Cyber Protect, a device protection service, SmartSupport, a device swop and refresh plan, and a free overseas call and SMS blocking service.

For some insurers, cyber protection is offered as a feature of broader home insurance plans.

MSIG, which began offering personal cyber protection as part of its HomeEasy plan in late 2024, said: “This addition is part of the value-added benefit to raise awareness of cyber security among consumers.”

Commenting on the emergence of personal cyber insurance, industry experts say it is advisable for consumers to study the wording of a policy before purchase.

A spokesman for the Financial Industry Disputes Resolution Centre (Fidrec) said: “Based on our experience so far, the disputes relating to personal cyber insurance arise because the fraud experienced by the policyholder is not covered by the terms of the policy.”

One notable group of exclusions are confidence scams. These are scams that involve gaining the trust of a victim such as through romance, or the promise of jobs and returns from financial investments.

Other exclusions include reckless or dishonest acts of the insured, cryptocurrency transactions or gambling activities. They may have sub-limits for different types of cyber-security events and expenses incurred.

“Consumers would do well to take note of the precise policy wordings and what they cover, paying attention to situational limits and any exclusions before they make a purchase,” said Fidrec’s spokesman.

Job and investment scams resulted in the highest losses in 2024, accounting for 42.8 per cent of all scam losses combined. These categories fall outside existing insurance plans, underlining the continued need for individual vigilance.

Mr Pramodh Rai, co-founder of cyber-security firm Cyber Sierra, said there is an underlying business rationale to the choice of loss scenarios covered by insurers.

“Insurers can maintain profitability by targeting high-frequency, low-severity risks – such as e-commerce fraud and identity theft – applying sub-limits and excluding large loss events like malware-driven bank thefts,” he said.

Insurers may also bundle insurance products with broader cyber-security tools to minimise risks, he added.

Telco Singtel’s Save & Secure, launched in February 2025, is an example. The bundle priced at $12.90 monthly includes three solutions: McAfee Triple Protect, Mobile Protect and Singtel Cyber Loss Protect Lite.

McAfee Triple Protect safeguards up to two devices with anti-virus scanning, secure VPN (virtual private network) and identity theft monitoring, while Mobile Protect filters over 600,000 malicious links and blocks over 5,000 cyber threats, including malware and spyware.

Singtel Cyber Loss Protect Lite is a personal cyber insurance plan that covers financial losses from unauthorised access to customer devices. The policy assures up to $10,000 per policy year regardless of the number of insured events.

A spokeswoman for the Monetary Authority of Singapore, which regulates the financial industry, said insurance can be a useful complement, but it does not replace cyber hygiene and vigilance.

[ad_2]

Source link

Click Here For The Original Source.