[ad_1]

Report Overview

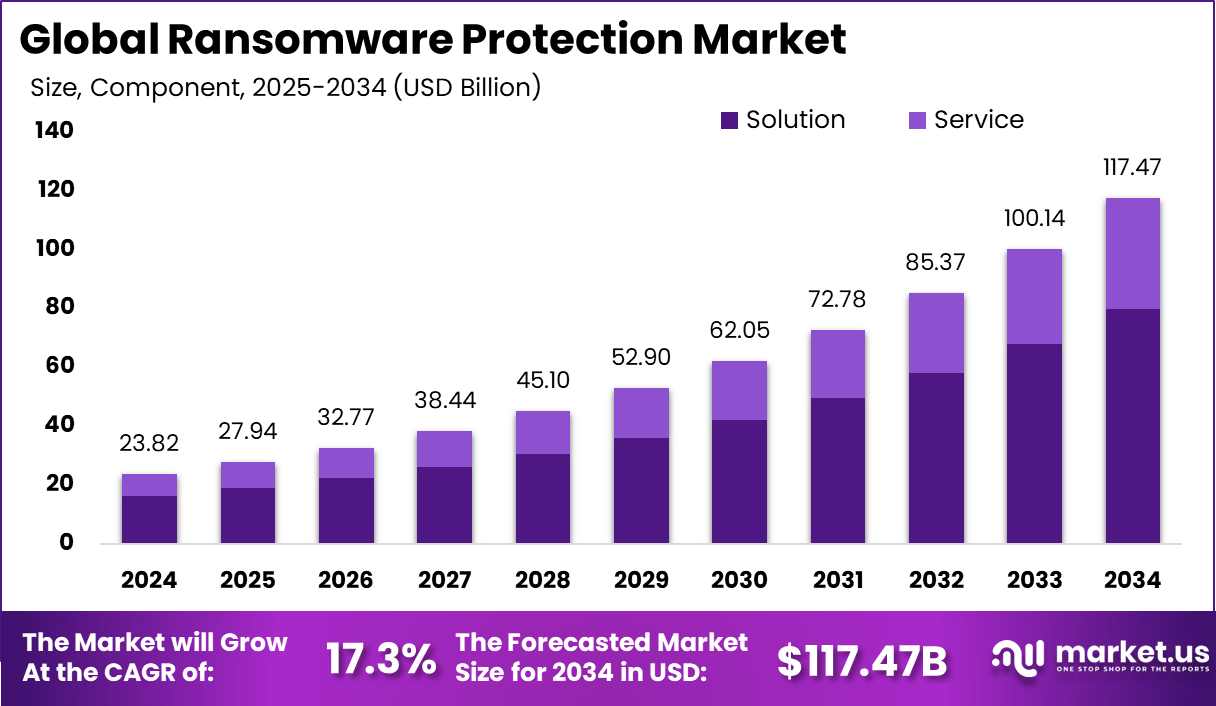

The Global Ransomware Protection Market size is expected to be worth around USD 117.47 billion by 2034, from USD 23.82 billion in 2024, growing at a CAGR of 17.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 9 billion in revenue.

![]()

![]()

The ransomware protection market is experiencing robust growth. The primary driving factors include the surge in ransomware-as-a-service models, widespread use of cryptocurrencies for ransom payments, increased phishing and social engineering attacks, and the rapid growth of remote work and cloud environments. There is rising demand for multi-layered protection that covers endpoints, networks, email, web, and data backup.

As per the latest insights from G2, LockBit alone accounted for USD 91 million in ransomware payments in 2025, solidifying its position as the most financially impactful ransomware group of the year. While LockBit dominated in terms of extortion value, RansomHub was reported as the most consistently active threat group, reflecting a shift in operational persistence among cybercriminals.

Across 2024, a record-high 5,263 ransomware attacks were documented – the largest number since tracking began by NCC in 2021 – indicating a substantial escalation in attack frequency. The average ransom payment surged to USD 2.73 million in 2024, nearly doubling from 2023, according to Varonis data. This increase highlights the growing financial burden on organizations, as threat actors continue to target high-value sectors with advanced techniques.

For instance, in March 2025, NetApp introduced its AI-powered Autonomous Ransomware Protection (ARP/AI), integrated directly into the ONTAP® operating system. This innovative solution offers real-time, on-device threat detection and response at the storage layer, distinguishing it from traditional, external security measures. ARP/AI utilizes advanced machine learning models trained on extensive datasets, achieving a 99% detection accuracy rate, as validated by SE Labs.

Technological adoption is accelerating around zero‑trust architecture, AI/ML‑based threat detection, behavioral analytics, and secure web gateways. These solutions are embraced to block lateral attack movement, identify anomalous behavior, and ensure rapid recovery. Moreover, these technologies offer automation and predictive threat response capabilities, which render protection more proactive and less reliant on manual oversight.

Key Takeaway

- In 2024, the Solution segment led the global ransomware protection market with a commanding 68% share, highlighting the continued focus of organizations on comprehensive security tools rather than standalone services.

- Network protection solutions captured a notable 30% market share in 2024, underlining the critical need for securing endpoints and communication layers from ransomware threats.

- Cloud-based ransomware protection accounted for 61% of the global market in 2024, reflecting the growing migration to cloud infrastructure and demand for scalable, real-time threat monitoring.

- Large Enterprises dominated the market with a 59% share in 2024, due to their broader digital infrastructure and increased exposure to cyber-attacks, driving investment in advanced protection tools.

- The BFSI sector led the end-user segmentation with a 21% market share, as financial institutions face heightened risks of data breaches and monetary losses from targeted ransomware attacks.

- The United States ransomware protection market was valued at USD 8.5 billion in 2024, registering a steady CAGR of 15.8%, supported by rising cyber incidents and increased spending on digital security infrastructure.

- North America maintained leadership in the global ransomware protection market, securing over 38% share in 2024, driven by strong regulatory frameworks, early technology adoption, and high cybersecurity budgets across industries.

U.S. Market Size

The market for Ransomware Protection within the U.S. is growing tremendously and is currently valued at USD 8.5 billion, the market has a projected CAGR of 15.8%. The surge is due to the high frequency and sophistication of ransomware attacks, which have resulted in companies investing heavily in cybersecurity.

In addition, the widespread adoption of cloud services and increasing remote work have increased the attack surface, so it is necessary to have better protection. Regulatory requirements for data protection and the growing awareness of cybersecurity risks further contribute to the demand for ransomware protection technologies in the U.S.

For instance, in July 2024, Tribes like the Citizen Potawatomi Nation and the Eastern Band of Cherokee Indians prioritized cyber resilience to safeguard data related to language preservation, healthcare, and utilities. The U.S. Department of Homeland Security responded by allocating over $18 million through the Tribal Cybersecurity Grant Program to bolster these initiatives.

![]()

![]()

In 2024, North America held a dominant market position in the Global Ransomware Protection Market, capturing more than a 38% share, holding USD 9 billion in revenue. The region faces frequent and sophisticated cyberattacks targeting critical infrastructure and businesses, prompting strong investments in security. The strict regulations on data protection and cybersecurity in the U.S. motivate organizations to implement advanced protection measures.

For instance, In May 2023, BullWall expanded into North America by launching its ransomware containment solution, Ransom Care. Already proven successful in Europe across sectors like healthcare, education, and government, the solution detects and isolates ransomware threats within seconds. This prevents both data encryption and exfiltration by containing affected systems swiftly, ensuring business continuity and data protection.

![]()

![]()

Component Analysis

In 2024, the Solution segment held a dominant market position, capturing more than a 68 % share of the global ransomware protection market. This prominence is attributable to its comprehensive approach, which integrates endpoint protection, network security, secure web gateways, and backup solutions into unified platforms.

End-user organizations favour these all‑in‑one offerings because they reduce complexity across diverse IT environments and bring coordination among multiple security layers. Ease of deployment is another advantage, as many solution packages include threat intelligence, automated remediation, and regular updates, thereby lowering the operational burden on internal security teams.

For Instance, in March 2025, Elastio partnered with Magna5 to enhance ransomware recovery solutions for businesses. Elastio’s Ransomware Recovery Assurance Platform integrates with Magna5’s Backup-as-a-Service, providing continuous inspection of backup data to detect hidden ransomware threats. This collaboration ensures that businesses have access to clean, uncompromised recovery points, enabling rapid and reliable recovery from cyber threats.

The leadership of the Solution segment is reinforced by the ongoing evolution of ransomware tactics. As adversaries employ ransomware‑as‑a‑service (RaaS) and multi‑vector extortion strategies, organizations have increasingly turned to solutions that blend behavioral analysis, AI‑powered detection, and zero‑trust principles. These capabilities enable proactive identification of anomalies and early-stage threats, which is critical since traditional signature‑based tools are often too slow to respond.

Application Analysis

In 2024, Network Protection segment held a dominant market position, capturing more than a 30% share of the ransomware protection market. This leadership is grounded in its critical role as the first line of defence against ransomware intrusions, effectively intercepting malicious traffic and isolating infected communications before they penetrate core systems.

Organizations have placed high strategic priority on network-layer solutions such as secure web gateways, intrusion prevention systems (IPS), and deep packet inspection tools. These technologies are increasingly powered by AI‑driven threat detection and real‑time command-and-control (C2) blocking, which is pivotal in disrupting ransomware attacks early in their kill chain

For instance, In April 2025, Tufin introduced its Orchestration Suite R25-1, aimed at strengthening cloud and network security operations. The update features extended support for Arista EOS and Cisco Meraki, enhanced cloud compliance monitoring for Azure and AWS, and improved policy enforcement across SASE environments through Zscaler integration. These improvements are designed to help security teams manage complex infrastructures more effectively and maintain consistent security policies.

![]()

![]()

Deployment Mode Analysis

In 2024, Cloud segment held a dominant market position, capturing more than a 61 % share of the ransomware protection market. This leadership reflects the growing preference for scalable, flexible, and cost-effective security models. Cloud-native solutions provide automatic updates, centralized management, and real-time threat intelligence – capabilities that appeal especially to organizations operating on hybrid and distributed networks.

The implementation of cloud-based ransomware protection enables real-time threat monitoring, quick updates to affected systems, and seamless integration with existing IT environments. Furthermore, the growing preference for remote work and hybrid infrastructures has accelerated the popularity of cloud deployment in favor of effective protection against ransomware.

For instance, in November 2023, Utimaco introduced u.trust LAN Crypt Cloud, a cloud-based file encryption management solution designed to protect sensitive and business-critical data against unauthorized access. This easy-to-use, file encryption-as-a-service solution ensures client-side encryption, meaning data remains protected regardless of its storage location – be it on-premises or in the cloud.

Organization Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more than a 59 % share of the ransomware protection market. This prominence can be attributed to their large attack surfaces and high stakes in safeguarding critical data and operations. Large organizations have complex IT infrastructures – spanning on-premise systems, hybrid cloud environments, and extensive endpoint fleets.

This complexity necessitates advanced ransomware protection frameworks that integrate detection, response, backup, and recovery functions. Enterprises also have dedicated cybersecurity budgets and teams, enabling adoption of AI-enhanced solutions and managed services capable of addressing sophisticated threats. As a result, they continue to lead in ransomware protection investments.

The leadership of large enterprises is further reinforced by rigorous regulatory mandates and high financial exposure to successful ransomware attacks. Industries such as banking, healthcare, and government are bound by compliance standards – GDPR, HIPAA, PCI DSS – which require robust security controls, logging, and incident response measures. Large organizations often face multibillion-dollar disruptions from ransomware, including downtime, penalties, and reputational harm.

For Instance, in April 2025, Elastio announced a strategic partnership with JetSweep, a premier cloud-based Disaster Recovery as a Service (DRaaS) provider, to enhance business continuity solutions and strengthen ransomware protection. This collaboration integrates Elastio’s Ransomware Recovery Assurance Platform into JetSweep’s AWS-based disaster recovery offerings, ensuring that recovery points are continuously analyzed for ransomware and other threats.

Vertical Segment Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) sector held a dominant position in the ransomware protection market, capturing more than a 21% share. This leadership can be attributed to the sector’s critical reliance on data integrity, stringent regulatory requirements, and the high value of financial assets, making it a prime target for cybercriminals.

Financial institutions, including banks, insurance companies, and investment firms, manage vast amounts of sensitive customer data and financial transactions, necessitating robust cybersecurity measures to mitigate the risk of ransomware attacks.

For Instance, In October 2024, the Bank of Jinhua, a city commercial bank in China, partnered with Huawei to implement a comprehensive ransomware protection solution, marking a significant advancement in financial data security. This collaboration led to the development of a multilayered “network + storage” defense system, featuring AI-driven threat detection, rapid response capabilities, and robust data recovery mechanisms.

Key Market Segments

By Component

- Solution

- Standalone anti-ransomware software

- Secure web gateways

- Application control

- IDS/IPS

- Web filtering

- Threat intelligence

- Others

- Service

- Professional Services

- Consulting

- Training and Education

- Support and Maintenance

- Managed Services

- Professional Services

By Application

- Network protection

- Endpoint protection

- Email Protection

- Database protection

- Web protection

By Deployment Mode

By Organization Size

By Vertical

- Government & Defense

- BFSI

- IT & Telecom

- Healthcare

- Education

- Energy & Utilities

- Retail

- Others

Emerging Trend

Integration of Artificial Intelligence in Ransomware Protection

In 2024, the integration of Artificial Intelligence (AI) into ransomware protection solutions emerged as a pivotal trend. AI-driven technologies, such as machine learning algorithms, enable real-time threat detection and automated response mechanisms, enhancing the efficiency of cybersecurity measures.

These advancements facilitate the identification of anomalous patterns indicative of ransomware activities, allowing for swift mitigation actions. The adoption of AI in cybersecurity frameworks signifies a proactive approach to counteract the evolving sophistication of ransomware attacks. Furthermore, AI’s role extends to predictive analytics, where it aids in forecasting potential vulnerabilities and attack vectors.

By analyzing historical data and identifying emerging threat patterns, AI empowers organizations to fortify their defenses against future ransomware incidents. This strategic utilization of AI not only enhances the resilience of cybersecurity infrastructures but also underscores the industry’s commitment to adopting cutting-edge technologies to combat cyber threats effectively.

Drivers

Escalating Frequency and Sophistication of Ransomware Attacks

The surge in ransomware attacks, characterized by increased frequency and sophistication, serves as a primary driver for the growth of the ransomware protection market. In 2024, ransomware payments and demands reached unprecedented levels, with the average extortion demand per attack surpassing USD 5.2 million.

This escalation underscores the critical need for robust cybersecurity measures to safeguard sensitive data and maintain operational continuity. The heightened threat landscape compels organizations across various sectors to prioritize cybersecurity investments.

The financial implications of ransomware incidents, including ransom payments and recovery costs, necessitate the adoption of comprehensive protection solutions. Consequently, the market for ransomware protection services and technologies is experiencing significant expansion, driven by the imperative to mitigate the risks associated with cyber extortion.

Restraint

Limited Awareness and Preparedness Among Organizations

A significant restraint hindering the effectiveness of ransomware protection is the limited awareness and preparedness among organizations regarding cybersecurity best practices. Many enterprises, particularly small and medium-sized businesses, lack comprehensive cybersecurity strategies and fail to implement essential protective measures.

This gap in preparedness renders them vulnerable to ransomware attacks, as they may not recognize the signs of an impending threat or possess the necessary resources to respond effectively. Addressing this restraint requires a concerted effort to enhance cybersecurity education and awareness across all organizational levels.

Implementing regular training programs, conducting simulated attack exercises, and fostering a culture of cybersecurity vigilance are critical steps toward bridging the preparedness gap. By prioritizing awareness and preparedness, organizations can bolster their defenses against ransomware threats and reduce the potential impact of such attacks.

Opportunities

Cloud-Based Solutions

The growing prevalence of cloud-based computing makes it a significant market for ransomware protection providers. For organizations of any size, cloud-based solutions are scalable to meet specific business needs and can be easily and quickly deployed, making management easier than on-premise systems. The use of these solutions enables real-time threat monitoring and automatic backups, which enhances the ability to fend off ransomware attacks.

For instance, In September 2024, LoadSpring Solutions expanded its cloud capabilities by integrating with Microsoft Azure, aiming to enhance digital transformation for project-intensive organizations. This move leverages Azure’s infrastructure to boost performance, scalability, and security, while also enabling smooth interoperability with Microsoft tools – ultimately streamlining workflows and improving overall productivity for clients.

Challenges

Data Privacy Concerns

Enforcing extensive ransomware protection often involves significant access to confidential organizational data and systems. This can raise concerns about data privacy, especially in highly regulated industries (e.g., healthcare, finance) or regions with strict data protection laws (e.g., GDPR in Europe). Organizations must ensure that their security measures comply with all relevant regulations and prevent data from being accidentally exposed to additional risks.

For instance, In April 2025, DaVita Inc., a leading U.S. dialysis provider with over 3,000 clinics, faced a major ransomware attack that disrupted operations across the country. The cyberattack encrypted portions of its network, forcing the company to adopt contingency plans to ensure patient care continued. Although DaVita has not revealed which data was impacted, the breach highlights significant concerns about data privacy, especially regarding the potential compromise of protected health information (PHI).

Key Players Analysis

Palo Alto Networks strengthened its position in ransomware defense through a strategic acquisition and product innovation. In April 2025, it announced plans to acquire Protect AI, targeting AI‑centric threat protection throughout model development and runtime. Concurrently, the launch of Prisma AIRS and updates to Cortex XSIAM 3.0 brought advanced AI‑powered email security alongside SASE enhancements.

CrowdStrike continued its rapid expansion by focusing on AI‑driven ransomware protection and targeted acquisitions. At RSA 2025, it introduced Charlotte AI Agentic Response and Workflows on its Falcon platform, emphasizing agentic AI orchestration. Later additions included Falcon Data Protection enhancements – covering cloud encryption, GenAI leak prevention, and macOS endpoint security.

SentinelOne captured momentum in ransomware defense through differentiated growth and AI innovation. Following CrowdStrike’s incident in 2024, SentinelOne emphasized its platform reliability and AI enhancements, gaining significant market interest. The company deepened its product forensics and response capabilities at RSA 2025 with “Purple AI Athena”, an agentic AI engine replicating expert SOC reasoning.

Top Key Players in the Market

- McAfee, LLC

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Note (*): Similar analysis will be provided for other companies as well.

- AO Kaspersky Lab

- Bitdefender

- FireEye, Inc.

- Malwarebytes

- SentinelOne

- Sophos Ltd.

- Symantec Corporation

- Trend Micro Incorporated

- Zscaler, Inc

- CrowdStrike

- Cisco Systems, Inc.

- Palo Alto Networks

- Others

Recent Developments

- In March 2025, McAfee was honored with two prestigious AV-TEST Awards for 2024: Best Advanced Protection and Best Performance. These accolades recognize McAfee Total Protection for its exceptional ability to detect and neutralize advanced threats, such as ransomware and infostealers, through its Advanced Threat Protection (ATP) tests.

- In January 2025, CrowdStrike Holdings Inc. (NASDAQ: CRWD) has been at the forefront of cybersecurity, particularly in ransomware detection and prevention. The company achieved a perfect score in an industry test assessing ransomware detection, protection, and accuracy. This accomplishment led to a 9.4% surge in its stock price, reaching approximately $409, marking it as one of the top performers in the S&P 500 that day.

Report Scope

[ad_2]

Source link